I recently had a warm and insightful discussion with Kaitlyn Osolnick, the Manager of Investor Relations at Accenture, about the company’s free cash flow performance.

As a key holding in our FCF US Quality Strategy, FCF International Quality Strategy, FCF US Quality Innovation Strategy, FCF Global Ex-US Quality Innovation Strategy, and FCF US Defensive Equity Strategy, Accenture is a globally renowned company at the forefront of providing professional services, technological solutions, and consulting expertise. Through a combination of deep industry knowledge, cutting-edge technology capabilities, and a diverse team of experts, the company consistently helps clients navigate the complexities of the modern business landscape and achieve sustainable growth.

Here are some key takeaways from our meeting:

1. Accenture’s cash efficiency, capex and depreciation, and changes in DSO are the key drivers of their free cash flow.

2. The company’s general differentiators, such as scale and their people-based business model, give them a competitive advantage in the market.

3. Accenture is also investing in generative AI, focusing on talent, AI for their navigator platform, and building solutions for repeatable success.

4. Some potential risks to their free cash flow performance include a deterioration in small deals and lower performance in North America.

5. However, Accenture has several growth opportunities, including its focus on larger deals and expanding its presence in emerging markets.

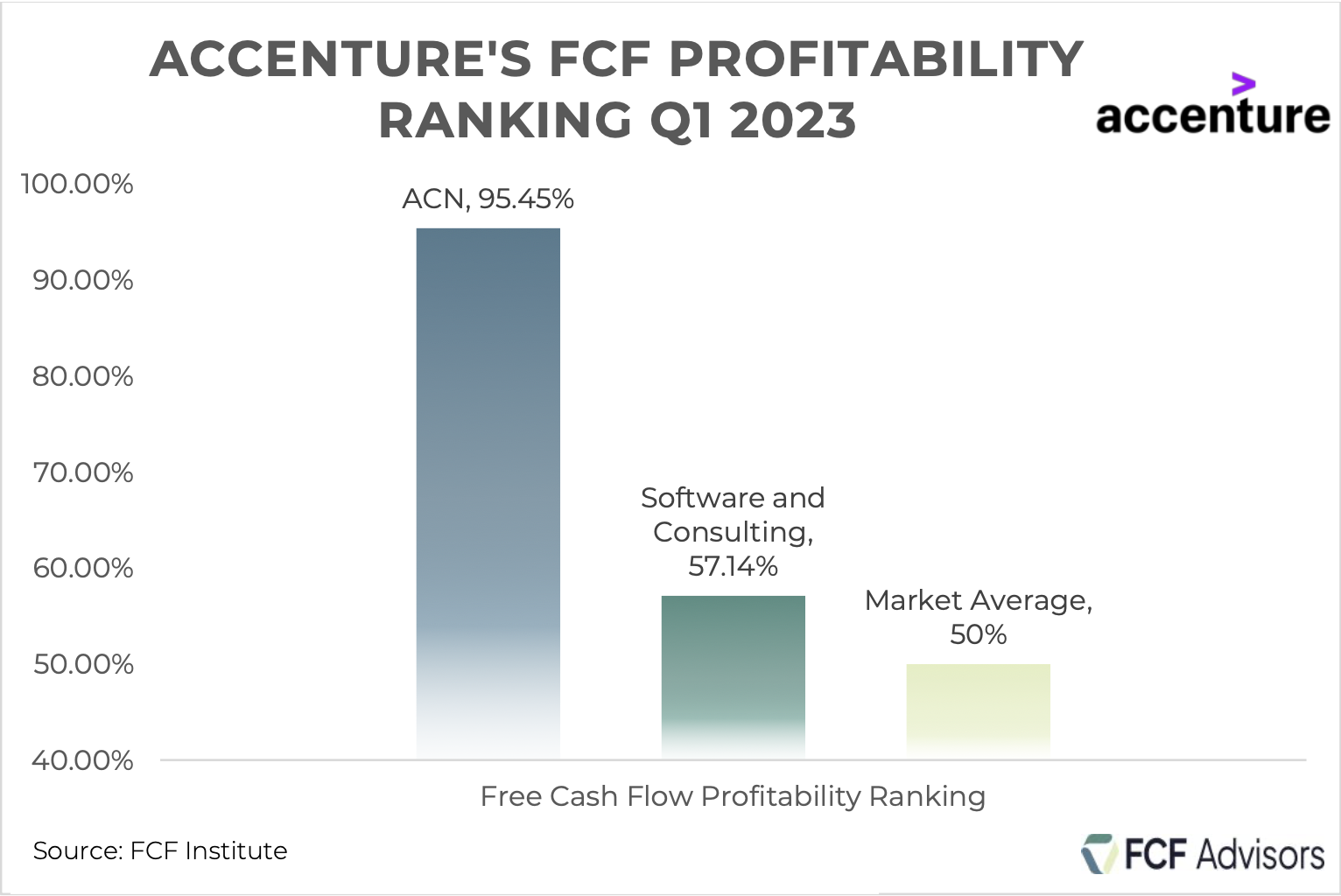

Accenture is one of the best Software and Consulting Industry companies in our Free Cash Flow Quality Model #FCFQM, an alpha model to identify company with strong and sustainable profitability that could potentially generate consistent excess returns.