FCF Research | The FCF Reality Check: Why This Isn't the Dawn of a New Market Cycle

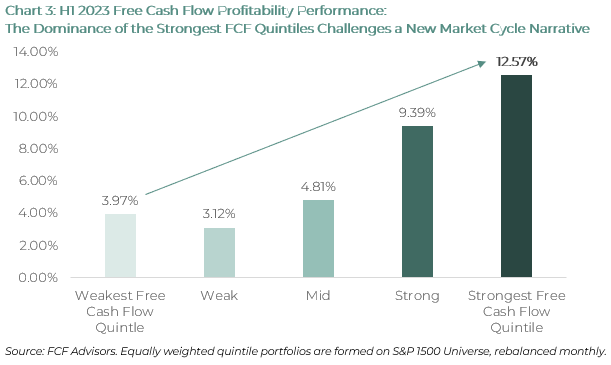

In this research report, we challenge the prevailing narrative of a new market cycle in H1 2023. Our analysis reveals large-cap stocks outperforming their smaller counterparts, a deep inversion of the T10Y-T3M spread signaling potential economic contraction, and robust performances by companies with strong Free Cash Flow (FCF) defying the typical recovery and expansion cycle characteristics. We suggest investors to continue focusing on quality stocks, particularly those with robust FCF.

Vince (Qijun) Chen, Director of Research, Connect with Vince on LinkedIn